Asking the question,

"Did I Follow My System or Not?" every time you do your trade review provides a simple way of assessing your trading consistency overall. There are three possible outcomes:

If you answered ‘No’

It is all well and good to have a system, but if you aren’t following it, you won’t know if it works or worse, you’ll wrongly blame it for poor results.

One of the most common beginner mistakes is not having a trading plan.

If you don’t have a trade plan, every trade becomes a guess. When it comes to reviewing, without a trade plan,

you will have no baseline to improve from and no data to learn from. Want to learn more about

trade plans?

If you answered ‘Yes’

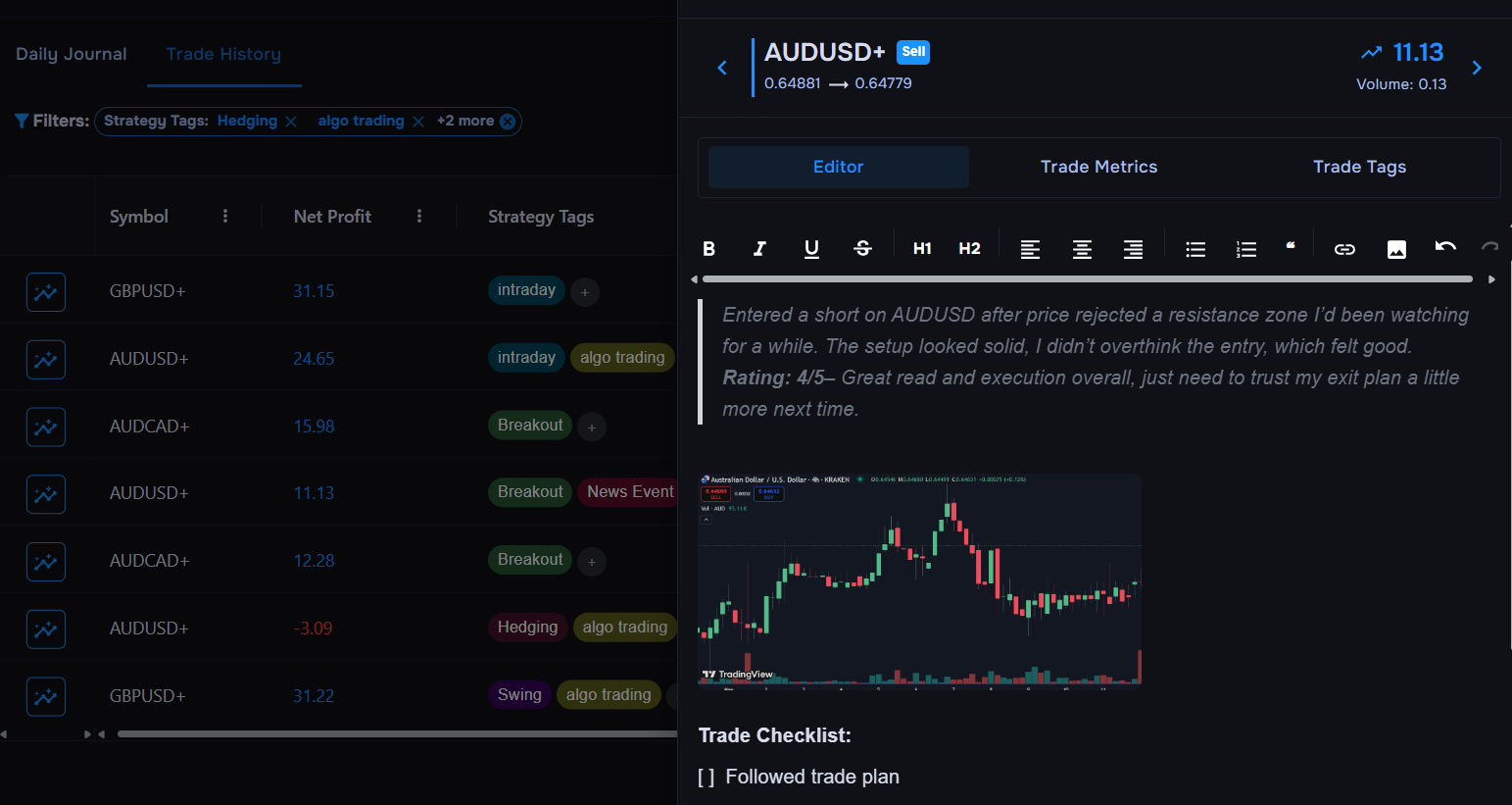

If your journal shows clear evidence that you’ve been sticking to your trade plan and reviewing trades with consistent depth, then you can confidently say you’ve been following your system.

That’s a good thing: now you have direction. The issue is less about how you're executing and more likely about your

system itself. Whether that’s your entry criteria, strategy, risk rules, or the timing of your trades.

A drop in performance might also be influenced by

market conditions, but if you’re seeing underperformance across a longer period, it’s probably not just a one-off bad day — it’s a

system-related issue. Before you blame your strategy though, make sure you’ve followed it across

enough trades to fairly evaluate it.

If you answered ‘Sometimes’

This is the usual response to this question. One week you make detailed journal entries, but the next you don’t, or at the start of the day you stick to your trade plan but by the end of the day, you’re placing revenge trades. This is probably what the advice ‘Be consistent’ is referring to.

When you aren’t consistent, it is even harder to know what is working for you or why things might be going wrong.

Whatever your answer is to the question, this one habit acts as a diagnostic tool, keeping you on course before small issues become full-blown account killers.

🔹 PnL Calendar: A colour-coded calendar gives you a quick view of your weekly performance. Combine it with your trade tags to spot patterns (e.g. do certain mistakes always happen on Mondays?).

🔹 PnL Calendar: A colour-coded calendar gives you a quick view of your weekly performance. Combine it with your trade tags to spot patterns (e.g. do certain mistakes always happen on Mondays?).